Almost everything you wanted to know about the Apple Card Engadget

With its ultra-modern product, Apple needs your money. But it additionally desires to be your personal finance teach. The organization is pitching the Apple Card as a manner to "help clients lead a healthier financial existence," frequently thru an intuitive app interface, a loss of expenses and a completely unique new payment shape. The Card, issued in partnership with Goldman Sachs, does appear to give purchasers greater manage and information in their debt. But it's also every other way to maintain users stuck inside the Apple walled lawn -- how can you switch to Android when you owe hundreds in your Apple Card?

The benefits for Apple are clean, however there is a potential upside for customers too. More and extra people are attracted to the ease of cellular wallets, and replacing your credit score card with your iPhone seems like a herbal evolution. Apple's guarantees about transparency, privateness and security are very desirable, and it is encouraging to see a tech titan tackle an enterprise that's traditionally taken benefit of client confusion. But earlier than you get too excited or angry about the Card, there are a few crucial problems to talk about.

What is the Apple Card and how do I get one?

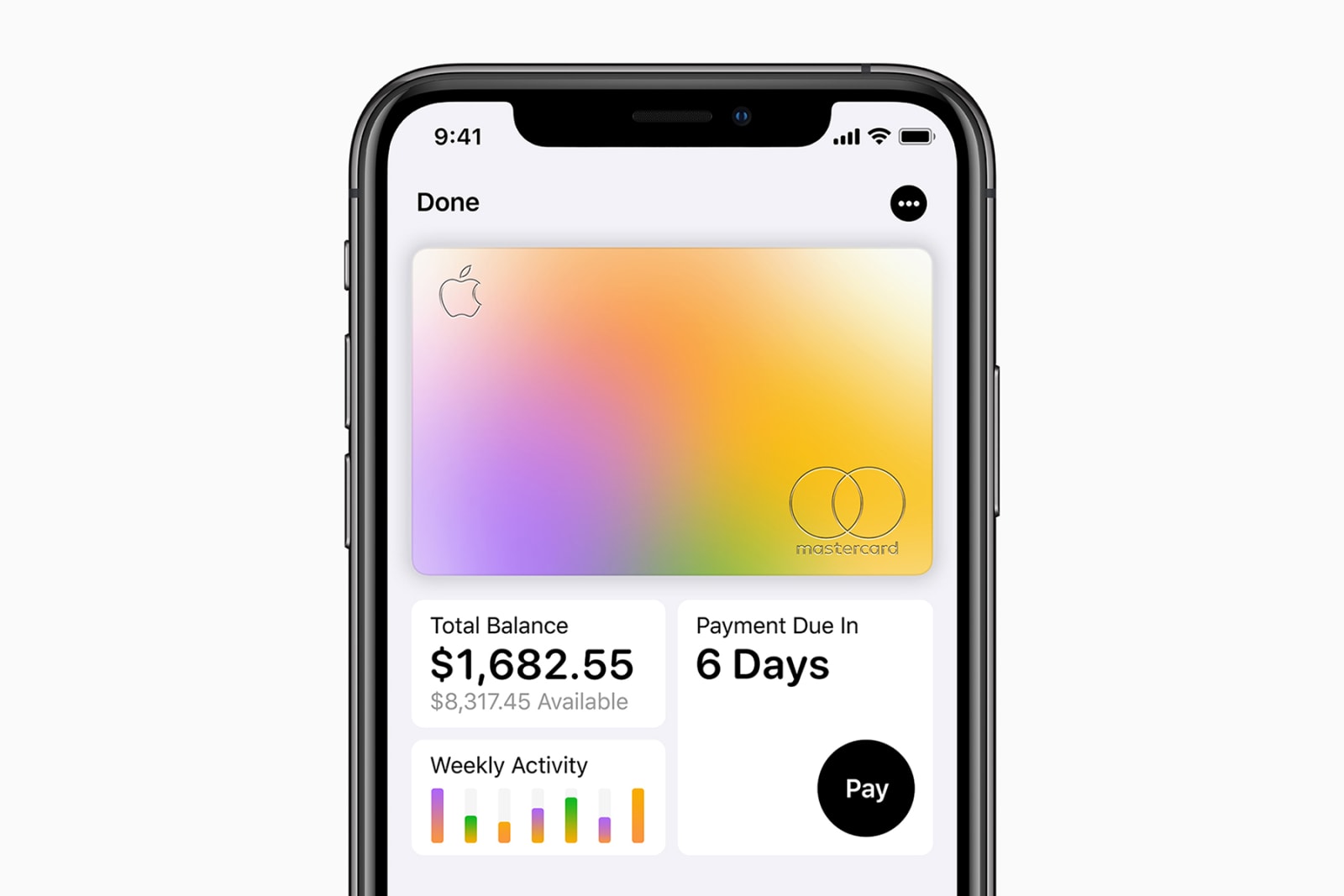

Basically, it is a credit score card. But it is distinctive from traditional playing cards in which you don't need a chunk of plastic earlier than you could begin using it. You can sign up from your iPhone, get permitted in minutes and use it right away thru Apple Pay. The employer will send you a bodily card (which Apple crafts from titanium) for instances while you want one, like for beginning a tab at a bar or to pay a merchant that doesn't take Apple Pay. You can get it free of charge, and it'll arrive within the mail inside two days.

This dramatically reduces the quantity of time spent ready on approval and get entry to in your credit score. Apple also promised now not to price overdue prices or global transaction fees or to even set a minimum payment. Interest rates are supposedly decrease than on other cashback playing cards, ranging between 13.24 and 24.24 percent (cutting-edge prices set via the Fed), and are decided by way of your creditworthiness.

What approximately those cashback gives?

Compared with present playing cards, Apple's rewards and cashback offers are underwhelming. Sure, the three percentage go back on Apple merchandise is better than the enterprise average, however it is highly restrained on wherein you can earn. Plus, the 1 percentage on physical card purchases and a pair of percent on Apple Pay transactions certainly can not compete. "[Those rates] might not sway clients away from competing merchandise, together with Citi Double Cash, which in the end offers 2 percent lower back on each purchase," in step with Zach Honig, editor-at-huge at The Points Guy.

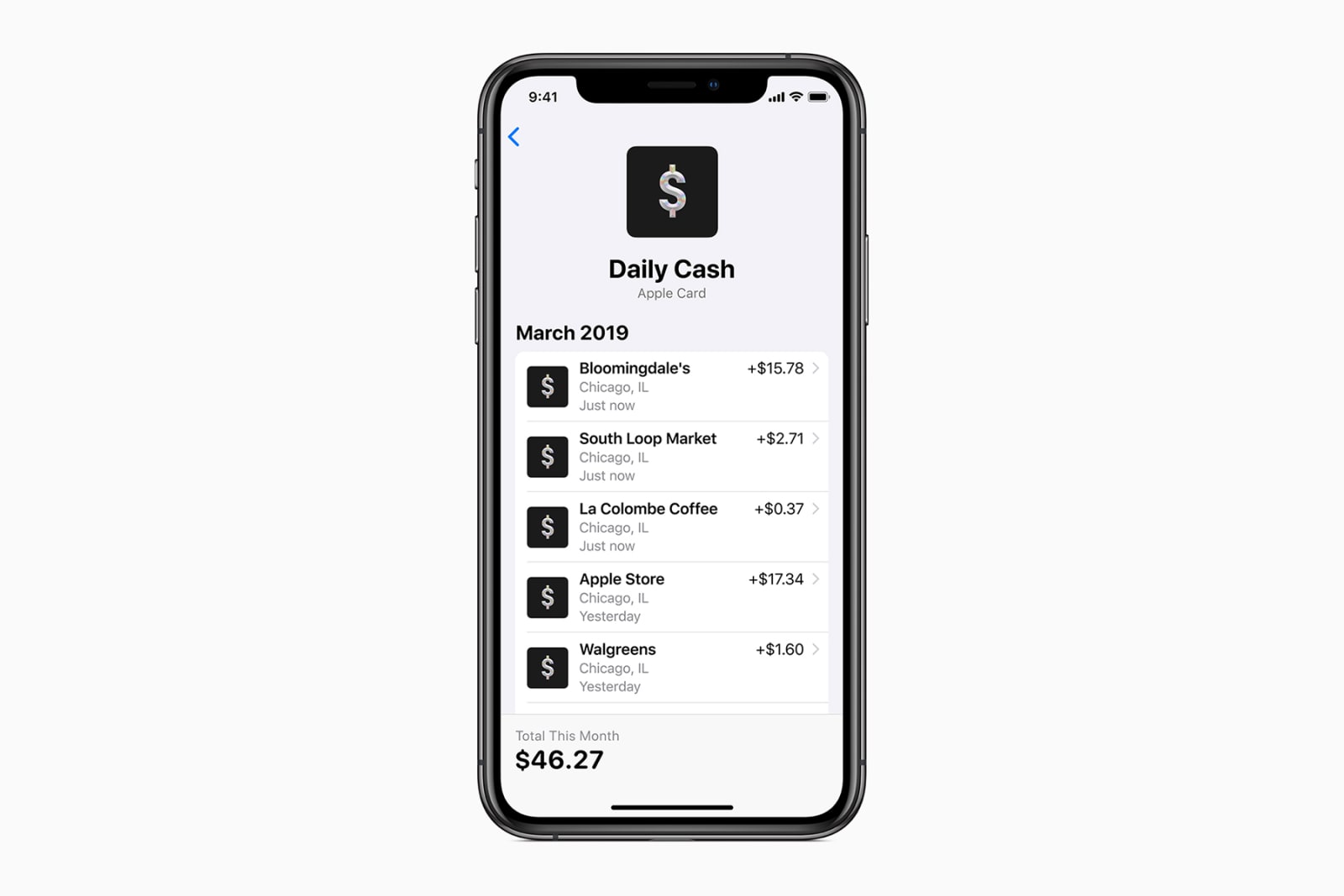

What is best is about Apple's Daily Cash application is that you may (essentially) immediately use the money you get lower back. The rewards are collected on a coins card, and you could get this out through your bank account or use the dollars on such things as apps, songs, films and on-line purchasing, or even pay your pals. The rewards hit the cardboard day by day, so you can acquire money greater quickly alternatively of getting to wait weeks to spend what you have earned. There's also no cap on how an awful lot Daily Cash you may accrue.

What happens after I lose that physical card or my iPhone?

Since the titanium card does not display your credit score card number, expiration date or signature, it makes it more difficult to thieve your data. But because all it has is your name, absolutely everyone together with your card ought to probably take it and begin spending. You'd ought to be short to fasten your card when you comprehend it's missing to avoid letting a thief rack up big transactions. If you've most effective temporarily misplaced your card, you could unlock your account once you've got retrieved it.

Compared with a traditional card, that is greater handy than calling your financial institution to get it canceled. But provider companies like Capital One have already been making it easier to maintain song of your card and suspend your account at will, so Apple is not breaking new ground here.

If you lose your iPhone, you will need to go to a computer and signal into your iCloud to discover it. The appropriate information is that Apple Pay transactions will nevertheless require your Face ID or fingerprint authorization, however bills with the bodily card may not. What's also first-class is that once your alternative telephone arrives, all you have to do is sign into your Apple account, and your Card information mechanically transfers over, too.

How will Apple assist me lead a healthier monetary life?

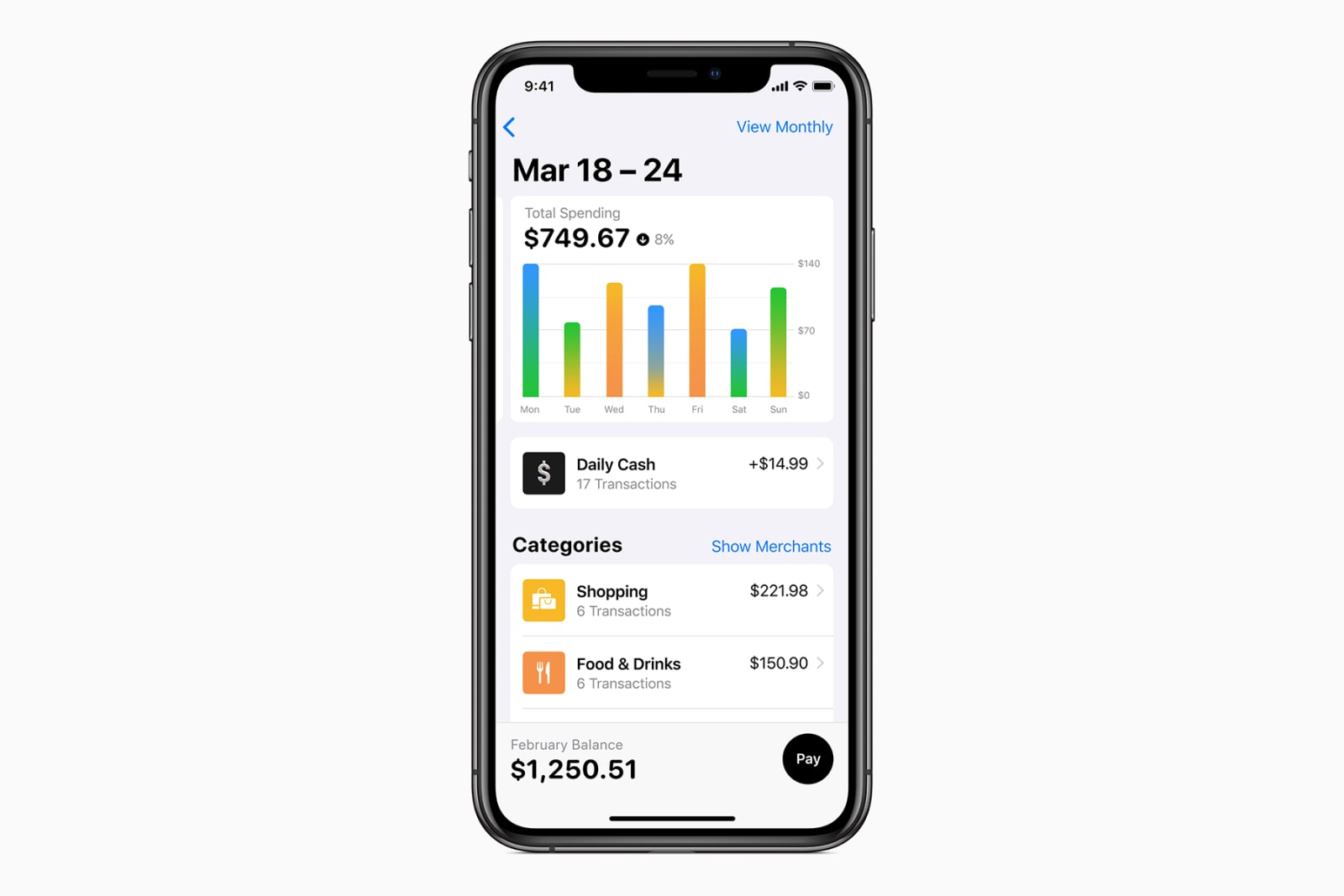

The maximum appealing factor about the Apple Card is its consumer-pleasant dashboard. Apple stated it will use on-tool device studying and GPS statistics to pick out and categorize your transactions. It'll additionally color-code your spending and use charts to show you where you drop the maximum cash.

This is not new; there are plenty of offerings to be had to song your prices and make feel of your behavior, Mint being the maximum widely known. But before everything look, Apple's interface appears to be simpler to apply and recognize.

Having all this facts in the front of you might not change your conduct at all. As with Apple's and Google's digital nicely-being services that display you ways an awful lot time you waste in positive apps, the purpose is more about instructing the person. It's totally up to you to restrict how tons money you spend ingesting at bars, however at least you will have the statistics.

Another way Apple says it's assisting you're making better monetary selections is by way of making your bills simpler to apprehend. Since there are not any overdue charges, finance experts are concerned that there's not anything preventing humans from taking all the time to pay off their money owed. The handiest component scaring you into paying on time is the truth that the longer you drag it out, the extra you'll owe.

The Apple Card dashboard need to make this concept painfully clear. It's meant to reveal how small increases in your monthly bills can lower your average interest owed thru an interactive animated wheel. When you need assist information how a good deal you must pay, you can additionally text or name a aid operator, that is quite handy.

One aspect remains doubtful, though. Since Apple hasn't set a restriction on how long you can move without making any bills, you may theoretically get away with in no way clearing your debt.

What approximately the security and privateness of these transactions?

It must be quite clear to anybody through now that every one our credit score card purchases are being used to target ads to us. But Apple and Goldman Sachs stated they won't sell your information for advertising or advertising and marketing purposes. (Though that doesn't suggest they might not use your data themselves or for different functions.)

As for the security of the bills, the Apple Card makes use of era similar to that of different cellular wallets like Apple Pay, Google Pay and Samsung Pay. Each transaction is tokenized, that means the figuring out variety on your card is masked and adjustments on every occasion you operate it. Basically, the level of safety right here is just like that of current digital payment structures. The main distinction is that since you may not have a bodily card to start with, Mastercard will need to ship your telephone the records remotely while you installation your account. It's no longer but clear if this introduces vulnerabilities that awful actors can take advantage of, however Mastercard has been powering credit playing cards for many years and possibly has safeguards against such attacks.

Who, if each person, must get the Apple Card?

For first-time credit score card candidates or the ones heavily reliant on debit, the Apple Card would possibly make experience. "Apple's platform will provide them an possibility to get their feet moist in a acquainted surroundings, earlier than they, hopefully, graduate to greater worthwhile merchandise," Honig stated. It's also a great way to get into the dependancy of paying more than the minimal each month.

The satisfactory element about the Apple Card, even though, is the spotlight it is shining at the significance of financial literacy. Not handiest does the declaration drum up media hobby around the topic, but it can also inspire users to train themselves on things like student loans and mortgages.

Like each most important monetary decision you're making, getting an Apple Card should not be taken lightly. Managing your credit calls for a high-quality deal of responsibility and some restraint. If you're considering it as but some other credit score line to apply on things you won't ever be capable of repay, don't do it. Apple might not be imparting a lot that present credit score card organizations haven't already, but its front into the gap will as a minimum create healthful opposition that bodes properly for purchasers.

Update (at 3:19pm ET, 3/28/2019): This article formerly said incorrectly that the Apple Card requires no minimal bills. There might be minimum payments, though Apple wants to inspire you to pay greater than just that. This publish has been edited to clarify.

Cherlynn's lifestyles is quite lit, tbh.

Let's block advertisements! (Why?)

//www.engadget.com/2019/03/28/apple-card-rewards-cashback-the entirety-you-want-to-know/

2019-03-28 19:57:42Z

52780253335683

0 Response to "Almost everything you wanted to know about the Apple Card Engadget"

Post a Comment