Almost everything you wanted to know about the Apple Card Engadget

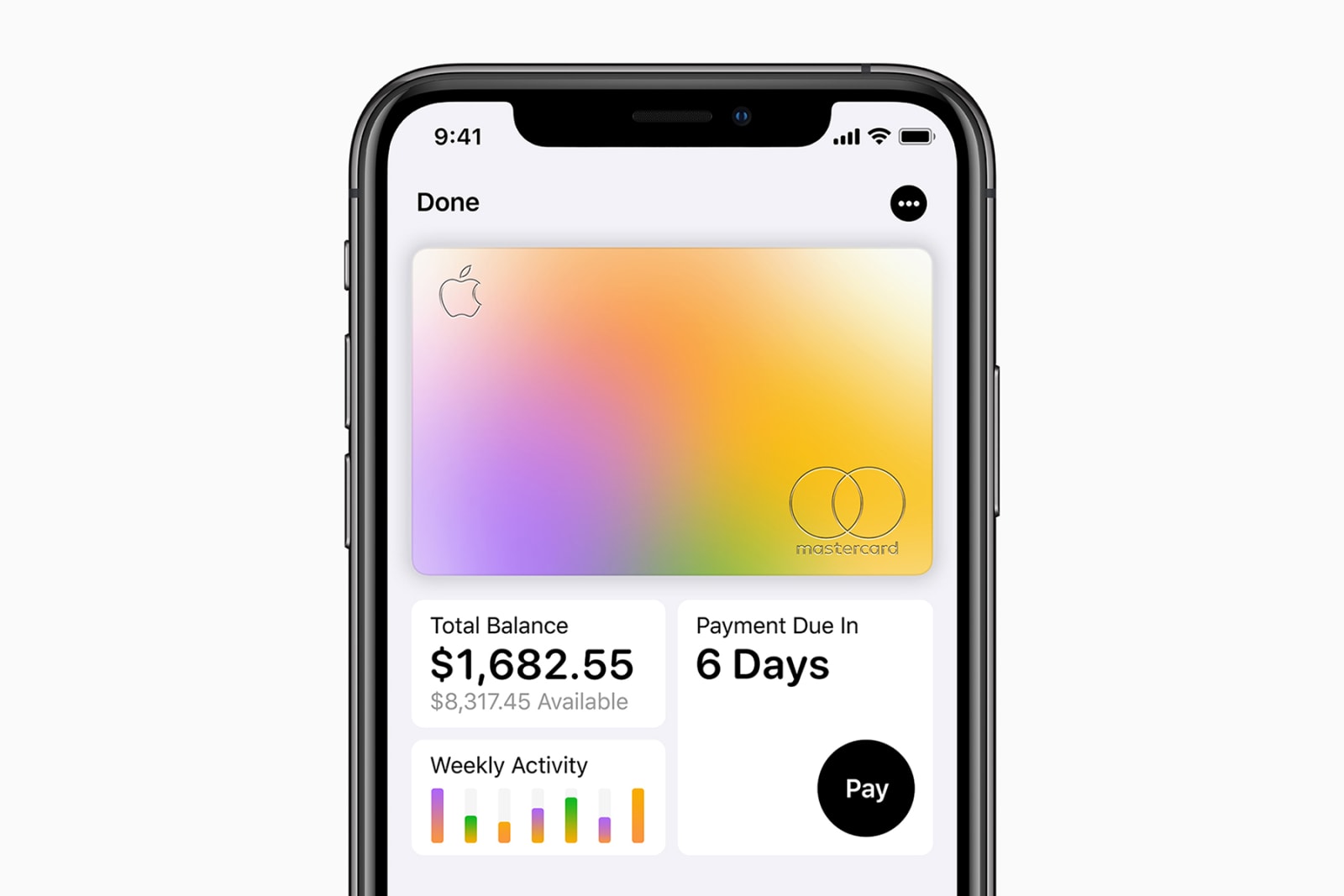

With its contemporary product, Apple wishes your money. But it also wants to be your private finance teach. The corporation is pitching the Apple Card as a manner to "help customers lead a healthier economic life," typically through an intuitive app interface, a lack of expenses and a completely unique new charge structure. The Card, issued in partnership with Goldman Sachs, does seem to give purchasers greater control and know-how in their debt. But it's also any other manner to preserve users stuck in the Apple walled garden -- how can you switch to Android while you owe lots in your Apple Card?

The advantages for Apple are clear, but there is a potential upside for customers too. More and greater humans are drawn to the ease of cellular wallets, and changing your credit card with your iPhone looks as if a natural evolution. Apple's promises about transparency, privacy and safety are very attractive, and it's encouraging to see a tech titan tackle an enterprise it's traditionally taken gain of purchaser confusion. But before you get too excited or angry about the Card, there are a few important problems to discuss.

What is the Apple Card and the way do I get one?

Basically, it is a credit card. But it's distinctive from traditional cards in that you do not need a chunk of plastic earlier than you may start the usage of it. You can join up out of your iPhone, get authorised in mins and use it without delay through Apple Pay. The agency will ship you a bodily card (which Apple crafts from titanium) for times when you want one, like for beginning a tab at a bar or to pay a merchant that does not take Apple Pay. You can get it free of charge, and it's going to arrive inside the mail within two days.

This dramatically reduces the quantity of time spent waiting on approval and access in your credit. Apple additionally promised not to charge past due expenses or global transaction fees or to even set a minimum fee. Interest prices are supposedly lower than on other cashback cards, ranging among thirteen.24 and 24.24 percent (current fees set through the Fed), and are decided by your creditworthiness.

What about those cashback gives?

Compared with existing playing cards, Apple's rewards and cashback gives are underwhelming. Sure, the three percent return on Apple products is better than the industry common, however it's rather constrained on where you could earn. Plus, the 1 percentage on physical card purchases and a couple of percentage on Apple Pay transactions actually can't compete. "[Those rates] may not sway clients far from competing products, such as Citi Double Cash, which ultimately offers 2 percent back on each purchase," consistent with Zach Honig, editor-at-large at The Points Guy.

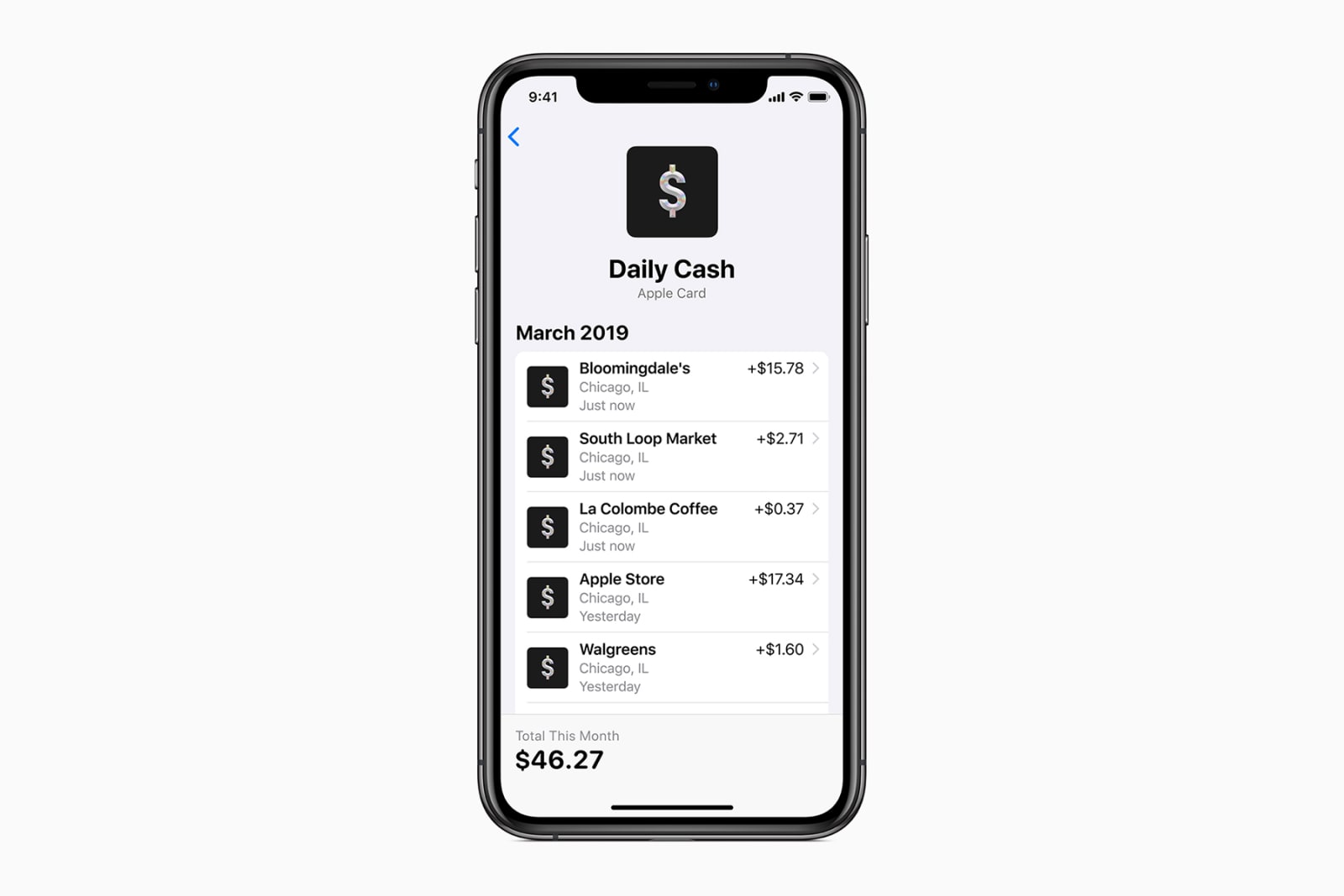

What is satisfactory is ready Apple's Daily Cash program is that you can (essentially) at once use the money you get lower back. The rewards are accrued on a coins card, and you may get this out through your financial institution account or use the greenbacks on things like apps, songs, movies and on-line purchasing, or maybe pay your buddies. The rewards hit the card day by day, so that you can accumulate cash greater quickly instead of having to wait weeks to spend what you've earned. There's also no cap on how a great deal Daily Cash you can accrue.

What happens after I lose that physical card or my iPhone?

Since the titanium card would not display your credit card variety, expiration date or signature, it makes it tougher to scouse borrow your statistics. But because all it has is your name, each person with your card may want to doubtlessly take it and begin spending. You'd should be quick to fasten your card when you realize it is lacking to keep away from letting a thief rack up massive transactions. If you've best temporarily out of place your card, you may unencumber your account once you've got retrieved it.

Compared with a conventional card, that is more handy than calling your financial institution to get it canceled. But provider carriers like Capital One have already been making it less complicated to preserve tune of your card and suspend your account at will, so Apple isn't breaking new floor right here.

If you lose your iPhone, you will want to visit a computer and sign into your iCloud to find it. The proper news is that Apple Pay transactions will still require your Face ID or fingerprint authorization, however payments with the physical card may not. What's additionally excellent is that once your alternative telephone arrives, all you need to do is sign into your Apple account, and your Card statistics automatically transfers over, too.

How will Apple assist me lead a more fit financial life?

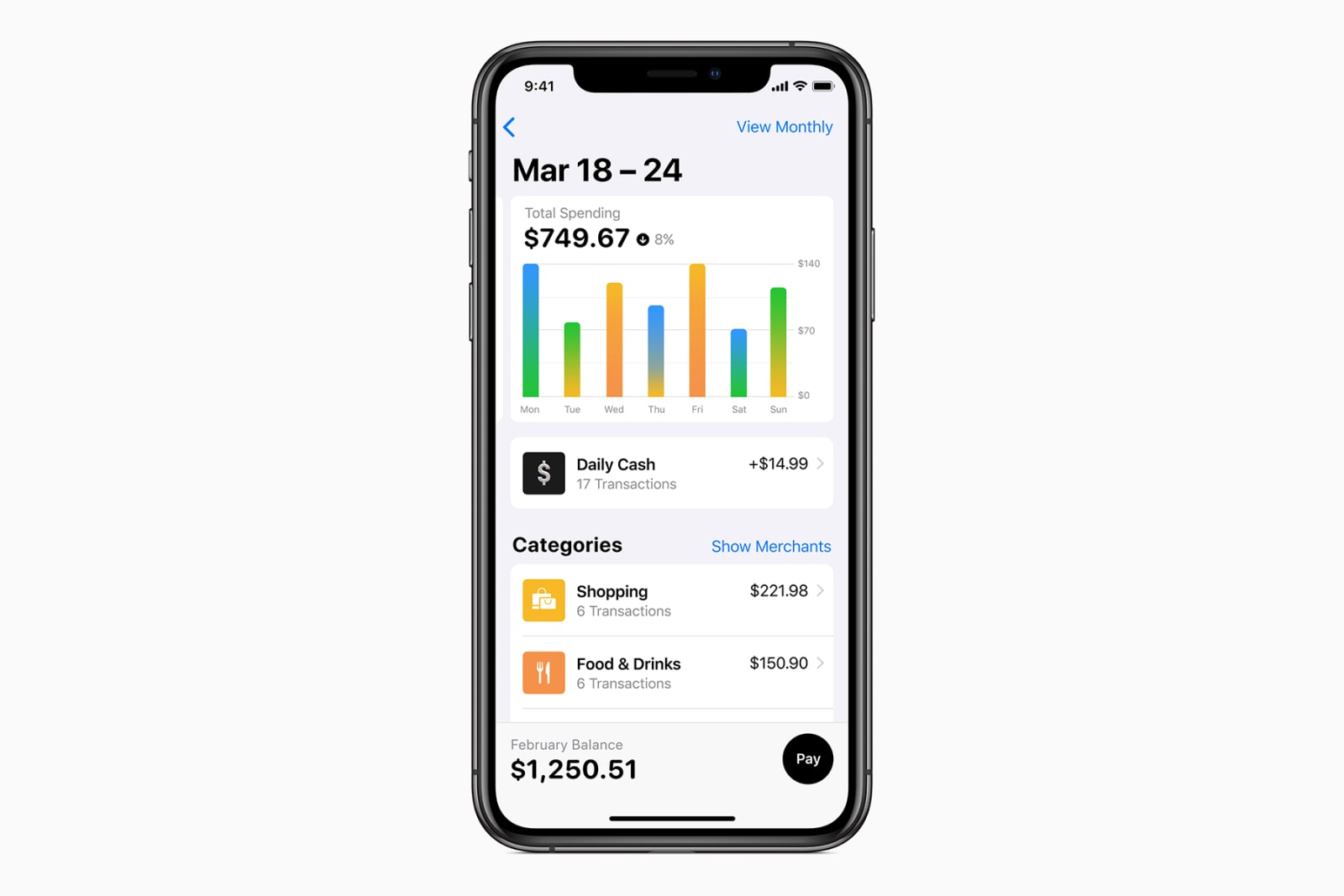

The maximum appealing element approximately the Apple Card is its consumer-friendly dashboard. Apple stated it's going to use on-device machine getting to know and GPS information to become aware of and categorize your transactions. It'll also shade-code your spending and use charts to reveal you wherein you drop the maximum cash.

This isn't always new; there are lots of services to be had to tune your expenditures and make feel of your habits, Mint being the most widely recognized. But before everything look, Apple's interface appears to be simpler to use and understand.

Having all this records in the front of you won't trade your behavior at all. As with Apple's and Google's digital nicely-being services that display you ways much time you waste in sure apps, the purpose is extra approximately teaching the consumer. It's absolutely as much as you to restrict how lots cash you spend consuming at bars, however at least you may have the data.

Another manner Apple says it's assisting you're making better financial decisions is by way of making your bills less difficult to understand. Since there aren't any past due costs, finance experts are concerned that there may be nothing preventing people from taking for all time to repay their money owed. The only aspect scaring you into paying on time is the reality that the longer you drag it out, the extra you may owe.

The Apple Card dashboard have to make this idea painfully clear. It's supposed to show how small will increase in your monthly bills can decrease your average interest owed via an interactive animated wheel. When you need help know-how how a lot you need to pay, you can also text or call a guide operator, that is pretty convenient.

One factor remains uncertain, although. Since Apple hasn't set a restriction on how long you may pass without making any payments, you can theoretically escape with never clearing your debt.

What approximately the safety and privateness of these transactions?

It should be quite clear to all people by means of now that each one our credit score card purchases are getting used to target ads to us. But Apple and Goldman Sachs said they may not promote your information for advertising or marketing purposes. (Though that does not imply they might not use your facts themselves or for other purposes.)

As for the safety of the bills, the Apple Card makes use of era similar to that of different cellular wallets like Apple Pay, Google Pay and Samsung Pay. Each transaction is tokenized, meaning the identifying quantity to your card is masked and adjustments every time you use it. Basically, the level of protection right here is much like that of current digital charge systems. The predominant distinction is that because you might not have a physical card initially, Mastercard will should send your phone the records remotely when you set up your account. It's now not but clean if this introduces vulnerabilities that horrific actors can exploit, but Mastercard has been powering credit score cards for many years and probable has safeguards in opposition to such attacks.

Who, if all people, ought to get the Apple Card?

For first-time credit card applicants or the ones closely reliant on debit, the Apple Card might make feel. "Apple's platform will supply them an opportunity to get their toes wet in a familiar atmosphere, before they, with a bit of luck, graduate to more rewarding products," Honig said. It's also a very good manner to get into the dependancy of paying greater than the minimum every month.

The high-quality element about the Apple Card, although, is the spotlight it's shining on the importance of economic literacy. Not most effective does the statement drum up media hobby around the subject matter, but it may additionally encourage customers to educate themselves on things like student loans and mortgages.

Like each essential economic decision you are making, getting an Apple Card shouldn't be taken lightly. Managing your credit requires a first-rate deal of duty and a few restraint. If you are considering it as but some other credit line to apply on stuff you may not ever be capable of pay off, don't do it. Apple won't be supplying a lot that present credit card agencies haven't already, but its entrance into the distance will at the least create healthy opposition that bodes well for purchasers.

Update (at 3:19pm ET, 3/28/2019): This article previously said incorrectly that the Apple Card requires no minimum bills. There may be minimum bills, though Apple wants to inspire you to pay more than just that. This post has been edited to clarify.

Cherlynn's lifestyles is quite lit, tbh.

Let's block commercials! (Why?)

//www.engadget.com/2019/03/28/apple-card-rewards-cashback-the whole lot-you-want-to-recognise/

2019-03-28 20:12:31Z

52780253335683

0 Response to "Almost everything you wanted to know about the Apple Card Engadget"

Post a Comment